All Categories

Featured

Table of Contents

You are not being granted any kind of property legal rights. There is a three year redemption duration for the majority of homes cost the tax obligation lien sale and during that time, the residential property still belongs to the analyzed proprietor. Very couple of real estate tax liens actually most likely to act. Tax liens not offered at the sale are held by the county and are typically offered for buy from the treasurer's workplace.

The interest price on taxes purchased at the tax lien sale is nine percent factors above the price cut rate paid to the Federal Reserve Bank on September 1st. The price on your certificate will stay the same for as lengthy as you hold that certificate. The price of return for certificates offered in 2024 will certainly be fourteen percent.

The certificates will certainly be held in the treasurer's workplace for safekeeping unless otherwise advised. If the taxes for taking place years become overdue, you will be alerted around July and given the chance to recommend the taxes to the certificates that you hold. You will certainly obtain the same interest rate on succeeding tax obligations as on the original certificate.

The redemption duration is 3 years from the day of the original tax sale. You will obtain a 1099 type revealing the quantity of redemption rate of interest paid to you, and a copy will additionally be sent out to the IRS.

Buying tax liens and deeds has the possible to be rather profitable. It is additionally feasible to purchase tax obligation liens and actions with less funding than might be needed for other financial investments such as rental residential or commercial properties. This is one of the extra preferred financial investment choices for owners of Self-Directed Individual Retirement Account LLC and Solo 401(k) programs.

Is Tax Lien Investing Profitable

There are two main courses, tax obligation liens and tax acts. A tax obligation lien is issued immediately once they building owner has stopped working to pay their taxes.

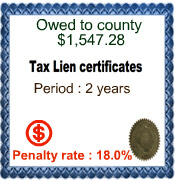

Such liens are after that sold to the general public. A capitalist purchases the lien, hence providing the district with the required tax income, and afterwards deserves to the building. If the residential property owner pays their taxes, the investor typically receives rate of interest which can be in the range of 12-18%.

If the home is not redeemed, the capitalist may confiscate on the property. Tax obligation liens and acts provide the possibility for generous roi, possibly with lower quantities of capital. While there are specific risk aspects, they are relatively reduced. Tax obligation lien investing is concentrated on the collection of interest and fines (where available) for the tax obligation debt.

The process for investing differs by state and by region. Most liens and acts are cost auction, with some public auctions taking area in-person at a county courthouse, and some occurring online. You will generally require to sign up in advancement for such public auctions and might be needed to put a deposit to take part.

Tax Lien Certificates Investing

In some jurisdictions, unsold liens or deeds might be offered available "over the counter" from the area staff's workplace or website after a public auction has actually been finished. Before participating in a public auction, you will certainly want to perform research to identify those residential or commercial properties you might have an interest in and make certain there are no issues such as other liens that may require to be settled or issues with the property itself that may produce issues if you were to take over possession.

:max_bytes(150000):strip_icc()/taxliencertificate.asp-final-b2b6b823202f45b9ab56efc51304ed44.png)

This period is suggested to offer the building proprietor a chance to settle their financial debt with the taxing authority. With a lien, redemption indicates that your Individual retirement account or 401(k) will get a cash advance, with rate of interest and any type of suitable charges being paid.

Tax lien and act investing is a location where checkbook control is a must. You need to be able to provide funds straight on brief notification, both for a down payment which should be signed up in the strategy entity name, and if you are the winning prospective buyer.

If you make a down payment and are not successful in bidding process at auction, the deposit can merely be gone back to the plan account without headache. The a number of days processing delay that includes functioning directly using a self-directed individual retirement account custodian simply does not operate in this space. When buying tax obligation liens and acts, you have to ensure that all activities are conducted under the umbrella of your plan.

All costs related to tax obligation lien investing need to originate from the plan account directly, as all income created need to be deposited to the plan account. tax lien investing secrets. We are frequently asked if the strategy can pay for the account owner to participate in a tax lien training course, and suggest against that. Even if your investing tasks will certainly be 100% via your plan and not involve any type of individual investing in tax liens, the IRS could consider this self-dealing

Tax Lien Investing Strategies

This would certainly additionally hold true of acquiring a building through a tax obligation deed and after that holding that property as a leasing. If your technique will certainly include getting properties merely to reverse and re-sell those homes with or without rehabilitation that can be deemed a dealer task. If implemented regularly, this would subject the IRA or Solo 401(k) to UBIT.

Just like any kind of investment, there is threat connected with spending in tax liens and actions. Investors should have the economic experience to gauge and comprehend the risks, execute the necessary persistance, and effectively provide such investments in conformity internal revenue service rules. Secure Advisors, LLC is not an investment advisor or provider, and does not advise any type of certain investment.

The information over is educational in nature, and is not planned to be, nor ought to it be construed as giving tax, legal or investment guidance.

Tax Lien Tax Deed Investing

6321. LIEN FOR TAX OBLIGATIONS. If any kind of individual accountable to pay any kind of tax obligation forgets or rejects to pay the very same after demand, the amount (including any kind of passion, extra quantity, addition to tax, or assessable penalty, together with any type of costs that may accrue in addition thereto) will be a lien in support of the United States upon all residential property and rights to residential property, whether actual or individual, belonging to such individual.

Certificate Investment Lien Tax

Department of the Treasury). Normally, the "person accountable to pay any kind of tax" defined in section 6321 needs to pay the tax within ten days of the created notification and demand. If the taxpayer falls short to pay the tax within the ten-day duration, the tax lien develops instantly (i.e., by procedure of legislation), and works retroactively to (i.e., develops at) the day of the evaluation, despite the fact that the ten-day period necessarily ends after the assessment date.

A government tax obligation lien arising by legislation as explained above stands against the taxpayer with no more activity by the federal government. The basic regulation is that where two or even more creditors have contending liens versus the same home, the creditor whose lien was improved at the earlier time takes priority over the financial institution whose lien was improved at a later time (there are exceptions to this rule).

Table of Contents

Latest Posts

Tax Forfeited Properties

Delinquent Tax Payments

Tax Owed Homes

More

Latest Posts

Tax Forfeited Properties

Delinquent Tax Payments

Tax Owed Homes